FinPath University

Helping you prepare for financial succcess!

Foundational Courses

Your Credit Score Might Be Costing You

Discover the ins and outs of your credit report and score.

Understanding the Elements of Your Retirement Income

Understand the elements of your retirement with the help of FinPath.

Simple Ways to Build Your Emergency Savings

Learn how to build and maintain emergency savings for those unexpected expenses.

Estate Planning 101: Learn the Basics

Get your affairs in order and learn the importance of estate planning.

5 Steps for Tackling Your Student Loans

Tackle student loan debt when you discover student loan forgiveness and repayment options!

Auto Finance: Things to Know Before Buying Your Next Car

Discover the financial tips and tricks the next time you purchase a car!

Upcoming Lessons

Planning Short & Medium Term Financial Goals Journey

That car, house, or vacation can be YOURS! Gain valuable insights, tools and strategies to saving for your short and medium term goals.

Home Buying 101: LIVE Webinar

We’re diving into the essentials of homeownership with a live webinar that covers everything you need to know to confidently navigate the home-buying process.

Activate your account and complete the STEP Assessment to get your recap email!

We’re closing out the month with a reflection on your progress and next steps to keep building toward your short term financial goals.

Retirement Security Month

We’re dedicating the month to building a secure financial future with educational resources and engaging activities to help you plan for retirement with confidence.

Social Security Strategies

Join us for a live webinar where we’ll explore key strategies to maximize your Social Security benefits and make informed decisions for retirement.

Activate your account and complete the STEP Assessment to get your recap email!

We’re wrapping up the year with a look back at your financial journey and actionable tips to start the new year strong.

Take Action

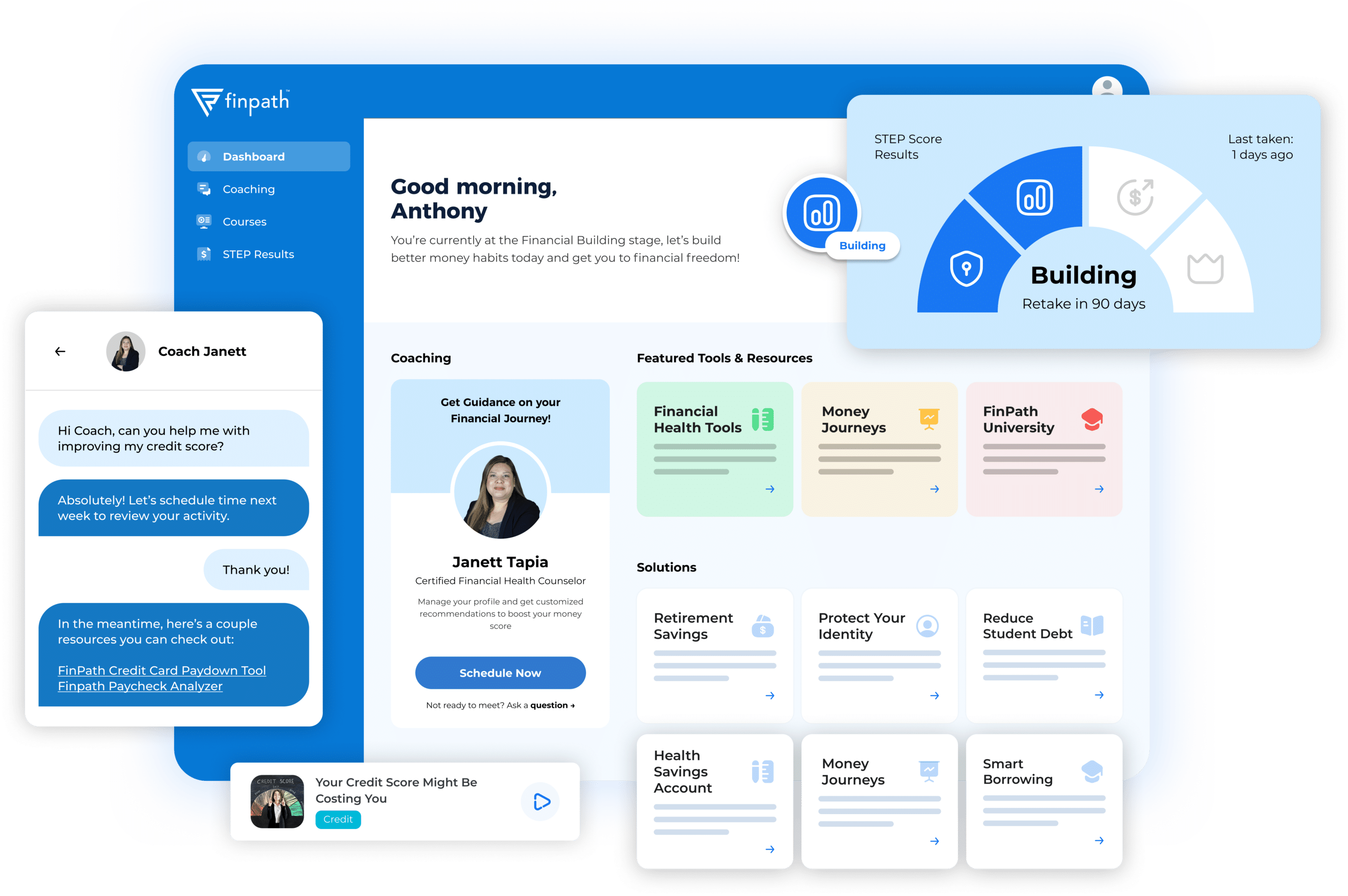

A little coaching can go a long way

Submit a question

Contact Us

Customer Service:

833-777-6545

Important Disclosures

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly in this brochure will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing in this website should be construed as guaranteeing any investment performance.

This website may contain forward-looking statements and projections that are based on our current beliefs and assumptions on information currently available that we believe to be reasonable; however, such statements necessarily involve risks, uncertainties, and assumptions, and prospective investors may not put undue reliance on any of these statements.