Financial Topics

What would you like help with?

Retirement Planning

Milestone Planning

Emergency Savings

Student Loans

Credit Scores

Debt Management

Open Enrollment

Creating a Budget

Big Purchases

Testimonials

What people say about us

What We Provide

At FinPath, we put you first

FinPath Courses

Participate in financial education courses led by our instructors.

Learn more →

Financial Coaching

Financial wellness is a journey. Your coach will see you through it.

Learn more →

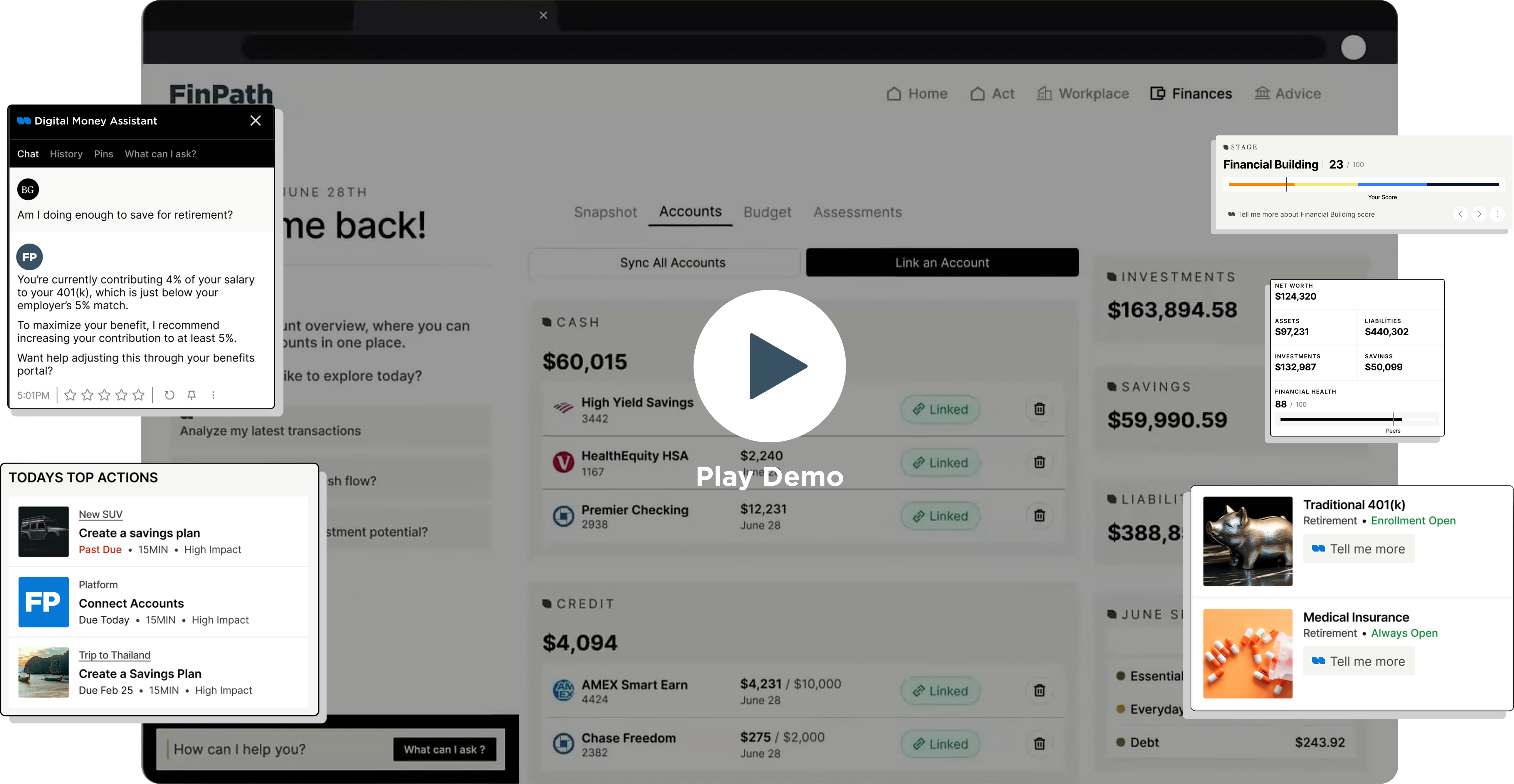

Digital Money Assistant

Powered by FinPath Intelligence, get answers to financial questions.

Learn more →

For financial shocks and beyond

Did you know 60% of households have experienced a financial shock in the last 12 months? Financial shocks come in different forms. It could be a car accident, a natural disaster, a medical emergency, or even a global pandemic.

When the day comes, our financial coaches will be ready to help.

FinPath coaches focus on these key areas:

Emergency Savings

Budgeting and Spending

Security and Protection

Credit Scores

Debt Management

Financial coaches work around your schedule

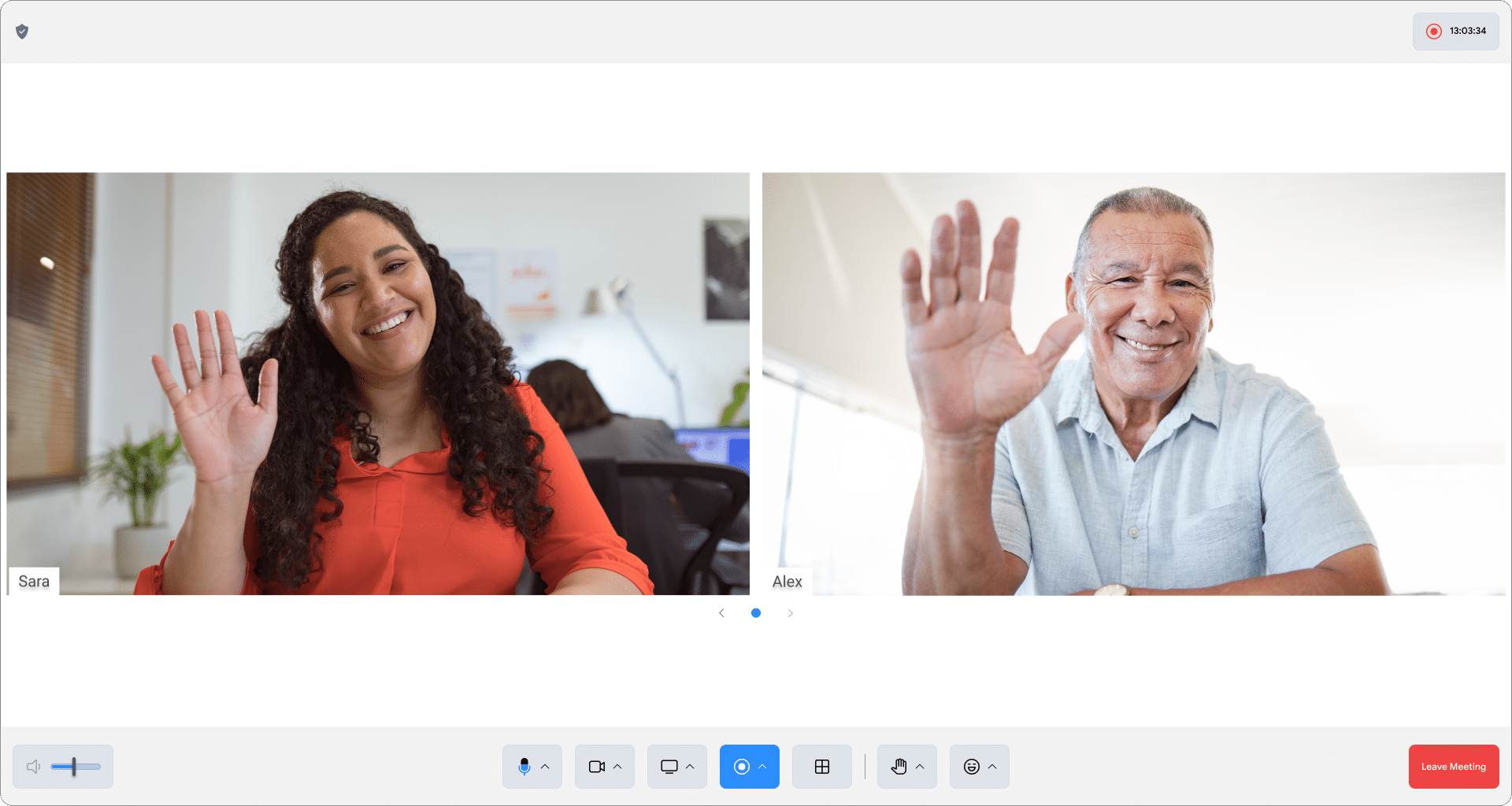

It’s 2025. You shouldn’t have to drive far and sit in a waiting room to talk to someone… unless you want to. With FinPath, you have the flexibility to meet with your coach at your convenience, from wherever you are.

We know how busy you are during regular business hours. Our coaches are available nights and weekends too. Just let us know and we’ll work around your schedule.

FinPath coaches are available via:

1:1 Live Video Chat

In-Person Appointments

Text

Any way you need

Schedule a Financial Coaching Session

Our Stats

We’re working on improving these alarming statistics

%

of Americans have not started saving for retirement at all

Source: finmasters.com

%

of Americans are unprepared for financial emergencies

Source: bankrate.com

%

of Americans are in debt (mortgages, student loans, etc.)

Source: creditkarma.com

%

of Americans live paycheck to paycheck

Source: retireguide.com