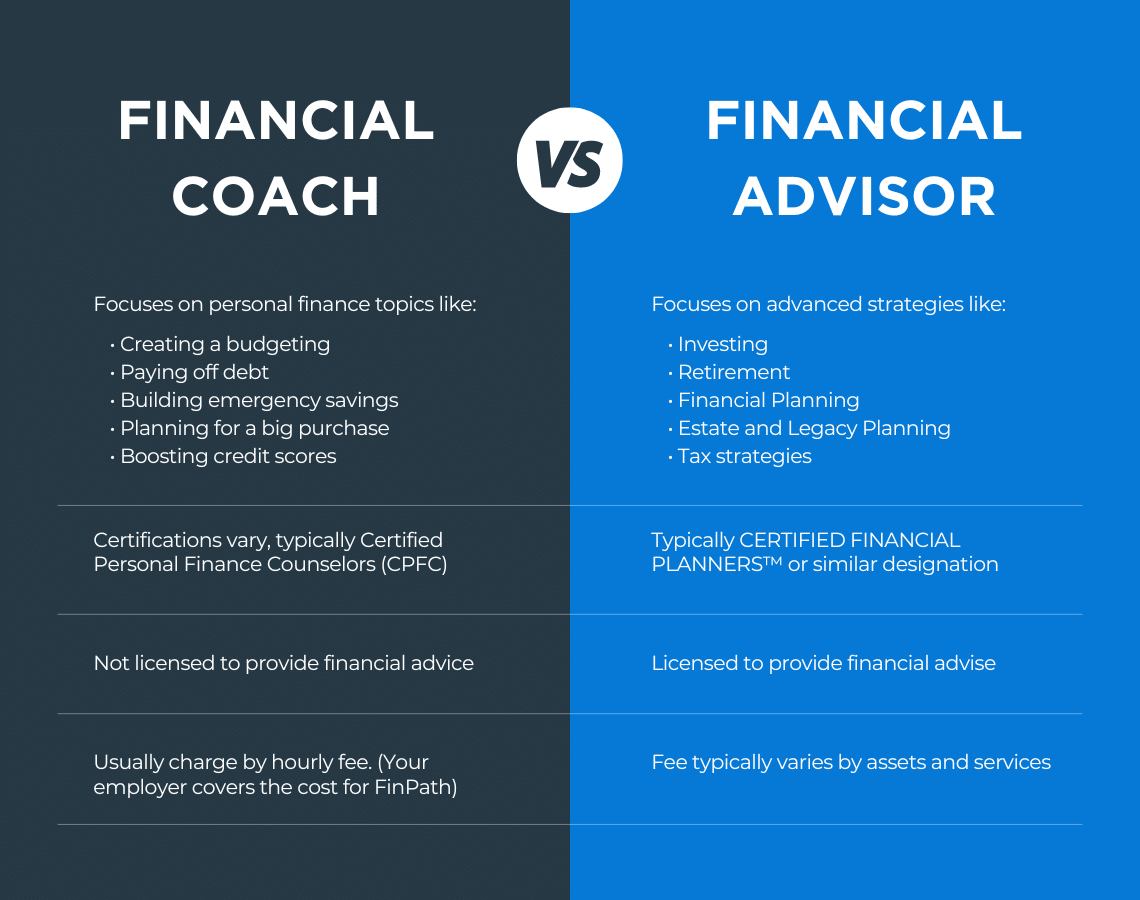

When it comes to managing your finances and achieving your financial goals, you may come across two important professionals: financial coaches and financial advisors. While their names might sound similar, their roles and areas of expertise differ significantly. In this blog post, we’ll explore the distinct characteristics of both financial coaches and financial advisors, helping you understand their unique contributions to your financial well-being.

Working with a Financial Coach

The Financial Coach’s Domain Financial coaches serve as guides and mentors on your journey to financial success. They focus on building a strong foundation of financial knowledge, empowering you to make informed decisions about your money. Here are some key aspects of a financial coach’s role:

- Goal Setting and Accountability:

Financial coaches work closely with you to define and prioritize your financial goals. They provide the necessary support and accountability to keep you on track, ensuring you stay motivated and committed to achieving your objectives. - Budgeting and Cash Flow Management

A financial coach helps you create a budget that aligns with your goals and values. They offer strategies and tools to optimize your cash flow, minimize unnecessary expenses, and save for the future. - Debt Management and Credit Improvement

If you’re struggling with debt or want to enhance your creditworthiness, a financial coach can provide guidance. They assist in developing effective debt repayment plans, exploring debt consolidation options, and offering strategies to improve your credit score.

Working With a Financial Advisor

The Financial Advisor’s Expertise Financial advisors specialize in providing comprehensive financial planning and investment advice. Their primary focus is helping you make informed decisions about wealth management, retirement planning, and investment strategies. Here are some key areas where a financial advisor excels:

- Investment Planning

Financial advisors analyze your financial situation, risk tolerance, and long-term goals to develop personalized investment strategies. They provide insights on asset allocation, diversification, and investment vehicles to help you build wealth over time. - Retirement Planning

A financial advisor assists you in creating a robust retirement plan. They evaluate your retirement needs, calculate savings targets, and recommend suitable retirement accounts and investment options to ensure a comfortable and secure future. - Tax Planning and Estate Planning

Financial advisors help optimize your tax strategies, exploring tax-efficient investment options and deductions. Additionally, they offer guidance on estate planning, including wills, trusts, and beneficiary designations, to ensure your assets are protected and transferred according to your wishes.

While financial coaches and financial advisors both play pivotal roles in your financial journey, they offer distinct areas of expertise and guidance. A financial coach focuses on building a strong foundation, providing support in budgeting, debt management, and financial goal setting. On the other hand, a financial advisor specializes in comprehensive financial planning, investment management, and retirement strategies. By understanding the unique contributions of both professionals, you can leverage their expertise to maximize your financial well-being and achieve your long-term goals.

Remember, working with a financial coach and a financial advisor can complement each other, offering a comprehensive approach to your financial success. Together, they provide the knowledge, guidance, and support you need to navigate the complexities of personal finance and build a prosperous future.