At FinPath, we put you first

Financial Coaching & Support Network

Truly setting FinPath apart from other programs is to a large network of Wellness Coaches ready to help users navigate their financial journey. Wellness Coaches do not work on commission and are completely unbiased—they are simply there to help. Sometimes it’s more convenient to speak with a real person who can explain things in a way that a video or learning module can’t.

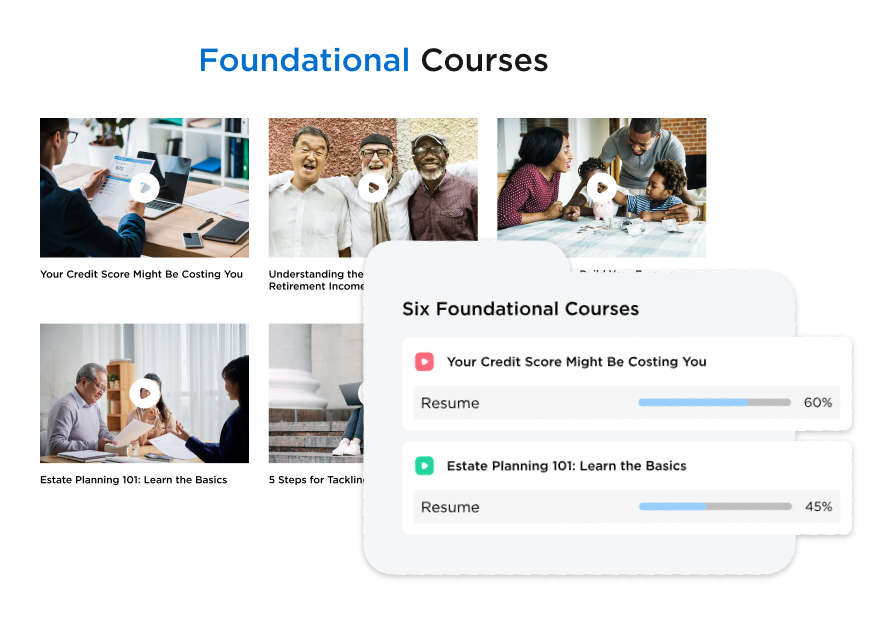

Step up your money skills with FinPath University

Courses are for everyone, no matter what sort of prior finance knowledge you have. Start with beginner 101 courses and move your way up the ladder with more complex topics. We break down complex financial topics using everyday situations. Popular courses this year:

- Debt Collection: Know Your Rights

- Student Loan Repayment: Keep Your Cashflow in Your Pocket

- Tax Tips: File Like The Pros

- Car Buying: Know Before You Go

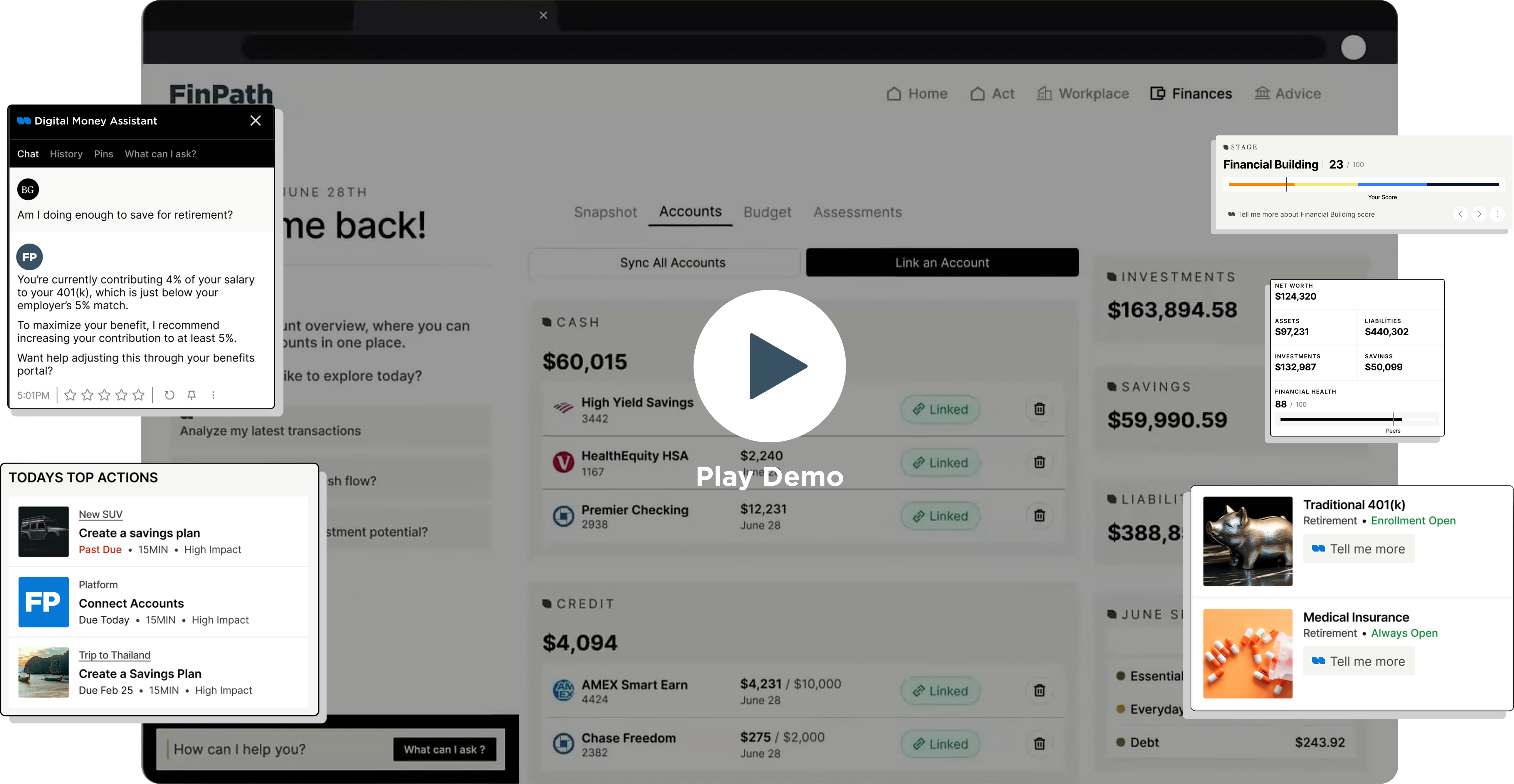

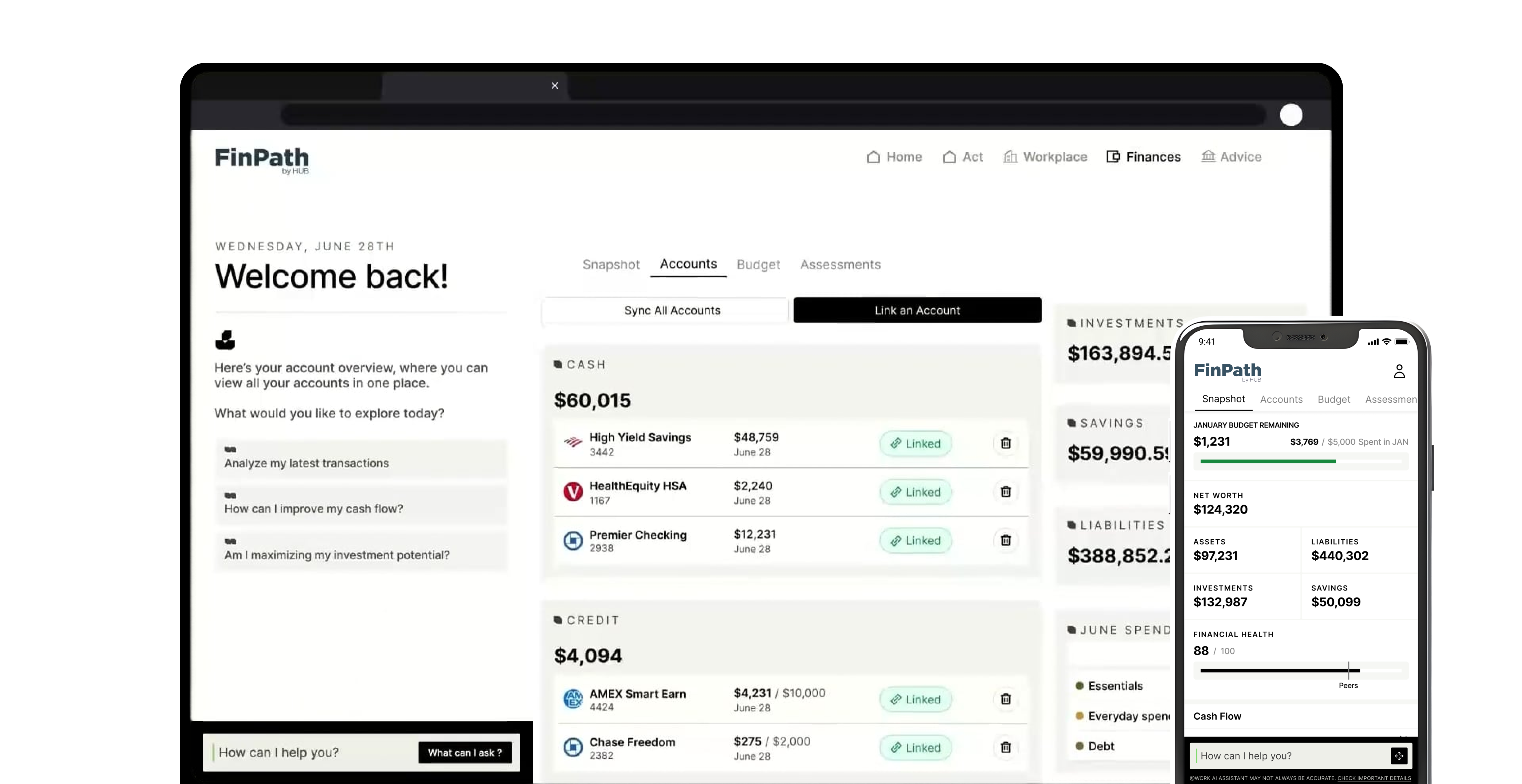

Digital Money Assistant

Take action and track your progress with powerful financial wellness tools

The days of Googling financial questions are over. Powered by FinPath Intelligence, you can ask your digital assistant any financial or workplace benefits question at any time and get professional, instant guidance that’s unique to your financial situation and priorities.

-

Paycheck Analyzer – See where your money is really going each paycheck to identify areas to improve your budget, save more, or invest in accounts like retirement.

-

Ask “Provide a spending report”

-

-

Connect Accounts – View checking, savings, retirement, and investment accounts all in one secure, convenient spot. Like bringing all of the pieces of the puzzle together for one clear picture – for your eyes only.

-

Ask ”Analyze my latest transactions”

-

-

Benefits Guidance – Navigate your employer benefits with ease 24/7 to make sure you aren’t missing out on a single perk – or dollar!

-

Ask “Tell me more about my workplace retirement plan”

-

-

Personalized Insights – Making a financial plan can feel overwhelming, that’s why the digital assistant provides actionable and scalable steps for real progress toward your goals.

-

Ask “What are my top actions”

-