Borrowers, it’s time to forgive your loans.

Your long-awaited student debt relief is here.

The Biden-Harris Administration and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers. This plan includes loan forgiveness of up to $20,000, an extension to the repayment pause, and amending the current student loan system.

Payment Pause Extension

The Biden-Harris Administration will extend the pause a final time through December 31, 2022, with payments resuming in January 2023.

Targeted Relief

The U.S. Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education and up to $10,000 in debt cancellation to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 or $250,000 for households.

New Student Loan System

The Biden-Harris Administration is proposing a rule to create a new income-driven repayment plan that will reduce future monthly payments for lower- and middle-income borrowers.

What is Public Service Loan Forgiveness (PSLF)?

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after 120 payments working full-time for federal, state, Tribal, or local government; military; or a qualifying non-profit.

Temporary changes, ending on Oct. 31, 2022, provide flexibility that makes it easier than ever to receive forgiveness by allowing borrowers to receive credit for past periods of repayment that would otherwise not qualify for PSLF.

Enrollments on or after Nov. 1, 2022 will not be eligible for this treatment. We encourage borrowers to sign up today. Visit PSLF.gov to learn more and apply.

What Should Borrowers Do?

There are three things borrowers should do to receive aid. Check out what you can do below:

Check your eligibility

Click to read

You’re eligible for student loan debt relief if your annual federal income was below $125,000 (individual or married, filing separately) or $250,000 (married, filing jointly or head of household) in 2021 or 2020.

• $20,000 in debt relief: If you received a Pell Grant in college and meet the income threshold, you’ll be eligible for up to $20,000 in debt relief.

• $10,000 in debt relief: If you did not receive a Pell Grant in college and meet the income threshold, you’ll be eligible for up to $10,000 in debt relief.

Get updates

Click to read

• Log in to your account on StudentAid.gov and make sure your contact info is up to date. They’ll send you updates both email and text message, so make sure to sign up to receive text alerts.

• If you don’t have a StudentAid.gov account (FSA ID), you should create an account to help you manage your loans.

• Make sure your loan servicer has your most current contact information so they can reach you. If you don’t know who your servicer is, you can log in and see your servicer(s) in your account dashboard.

Submit your application

Click to read

Borrowers may be eligible to receive aid automatically because relevant income data is already available to the U.S. Department of Education. If the U.S. Department of Education doesn’t have your income data, the Administration will launch a simple application which will be available by early October.

• The application will be available online by early October 2022.

• You’ll have until Dec. 31, 2023, to submit your application.

October application is now available

Applications are currently paused. If you’ve already applied, your application is on hold.

What You Need to Know

Borrowers may be eligible to receive relief automatically because relevant income data is already available to the U.S. Department of Education. If the DOE doesn’t have your income data, the Administration will launch a simple application which will be available by early October.

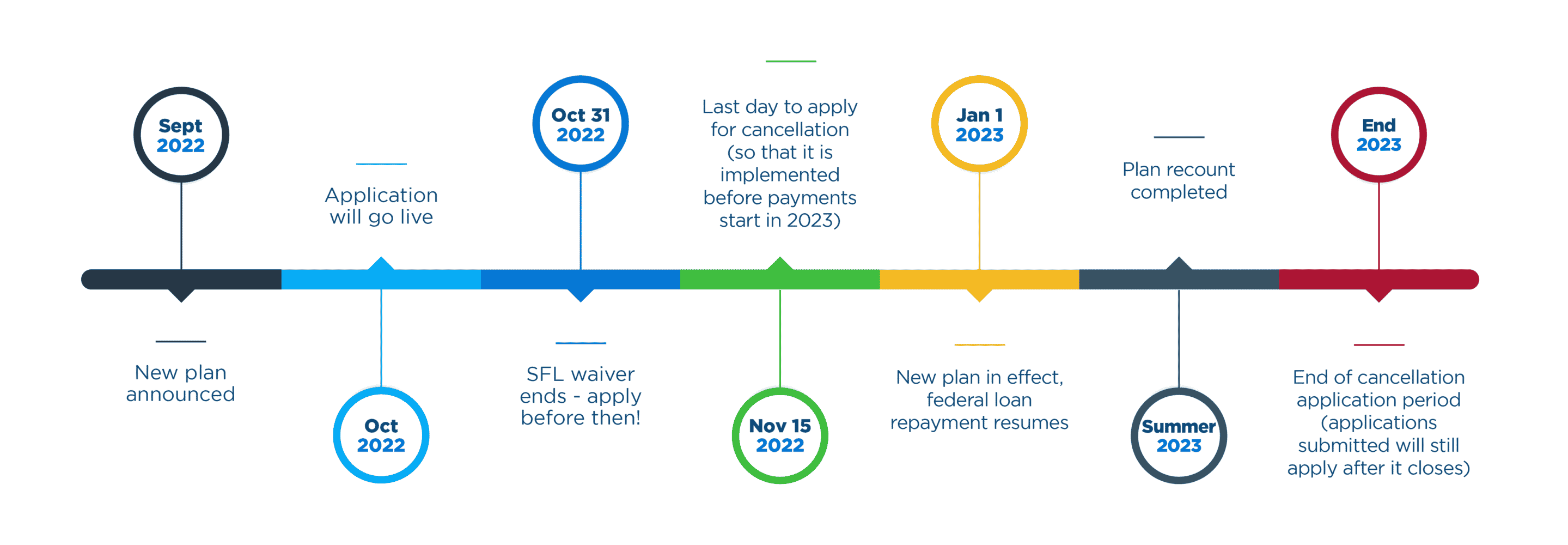

Borrowers are advised to apply before November 15th in order to receive relief before the payment pause expires on December 31, 2022. The Department of Education will continue to process applications as they are received, even after the pause expires on December 31, 2022.

Once a borrower completes the application, they can expect relief within 4-6 weeks.

If a borrower refinances their federal loans into a private consolidated loan, they won’t be eligible to have their federal loans forgiven.

Timeline

2022 Student Debt Relief, Explained

We created a four-page document detailing the plan, additional information, and need-to-know topics. Click the button for a downloadable PDF.

Need more information?

- Sign up for application alerts at: www.ed.gov/subscriptions

- Keep an eye for updates at: www.studentaid.gov/debt-relief-announcement/one-time-cancellation

- Look at other forms of administrative relief on: www.ed.gov

- Read on for consolidation: www.studentaid.gov/help-center/answers/article/pros-and-cons-of-consolidation

- View more on: www.studentaid.gov/debt-relief-announcement

Do you need help?

Schedule a virtual meeting with a FinPath Coach to talk about your student loans and come up with a plan to tackle your debt. We’re standing by to help!

Contact Us

Customer Service:

833-777-6545

Important Disclosures

Total Compensation Group Investment Advisory Services LP (“TCG Advisors, LP”) is a registered investment advisor regulated by the U.S. Securities and Exchange Commission (SEC) subject to the Rules and Regulations of the Investment Advisor Act of 1940, and is a part of TCG Group Holdings, LLP. Registration with the U.S. Securities and Exchange Commission does not imply a certain level of skill or training. We are located in Austin, Texas. A copy of our Form ADV Part 2 is available upon request.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.