Real Support,

with Real People.

Build better financial habits.

Meet with a FinPath coach to start navigating your financial journey.

How does this work?

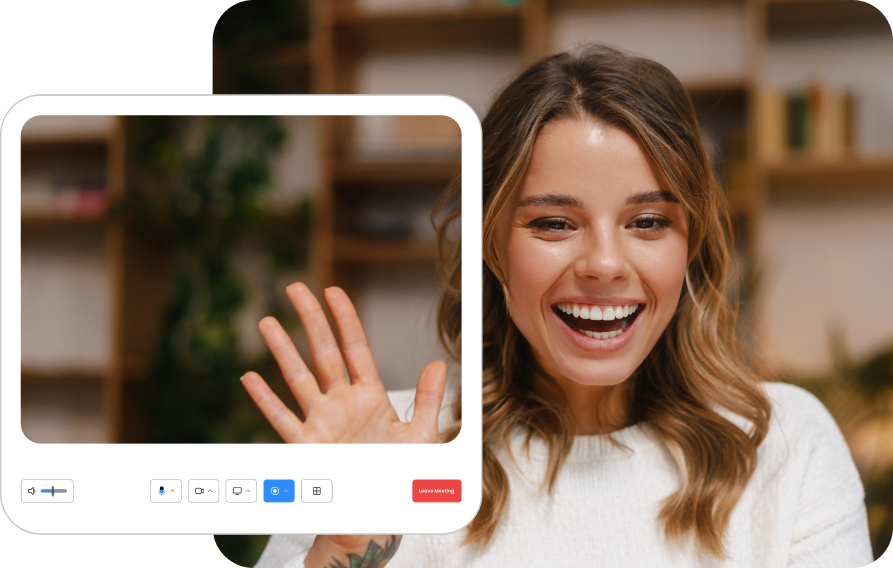

Step 01.

Each confidential, 1:1 coaching session can be a video call or phone call. Schedule sessions in advance or book on demand for real-time support.

Note: On-demand coaching is only available for registered users.

Step 02.

Meet with your coach.

Your coach will help you learn where your money is going, reflect on habits, and make a personalized plan to map out your path to financial independence.

Step 02.

Meet with your coach.

Your coach will help you learn where your money is going, reflect on habits, and make a personalized plan to map out your path to financial independence.

Step 03.

Work toward your goals.

Between sessions, work on your action plan. Take small, practical steps through the FinPath platform to improve your finances as your coach cheers you on.

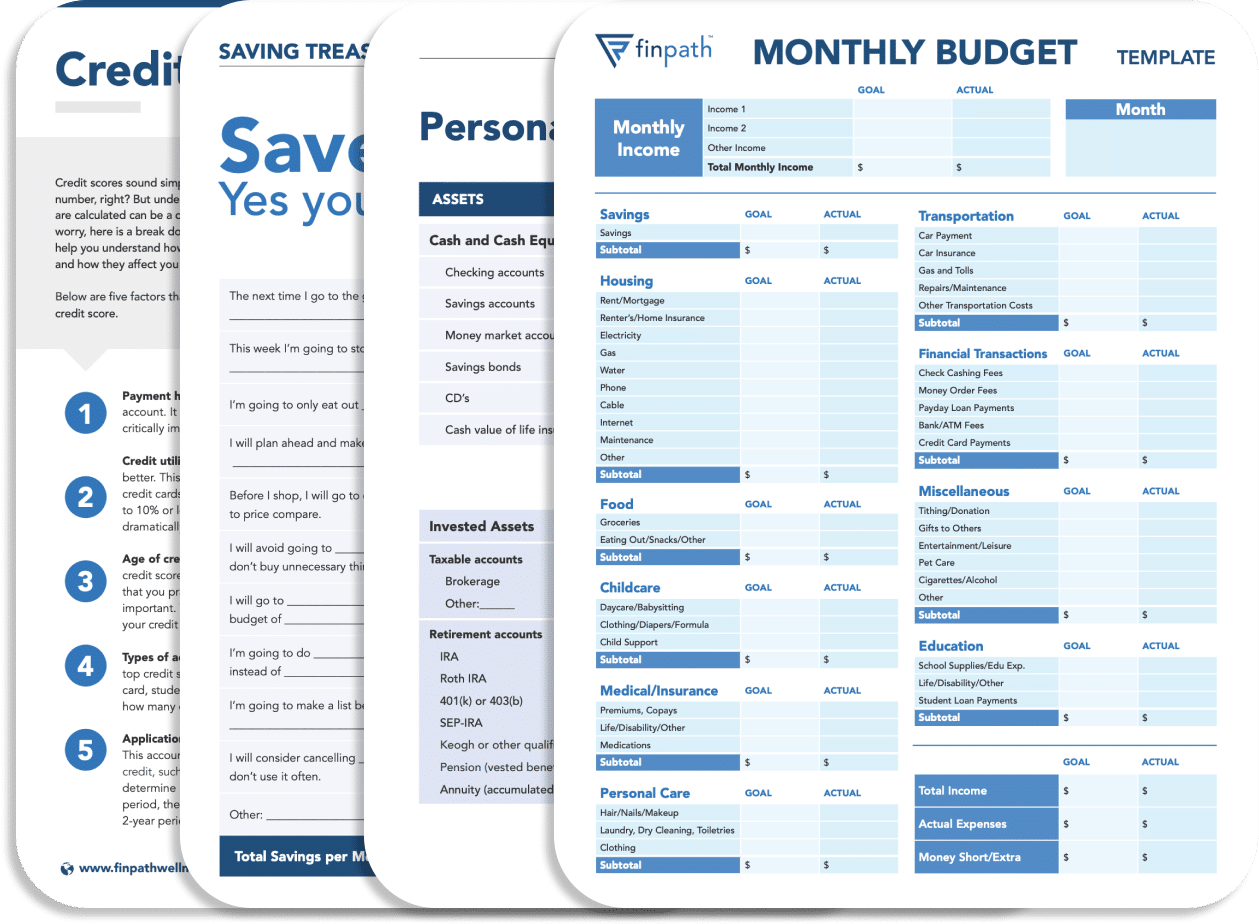

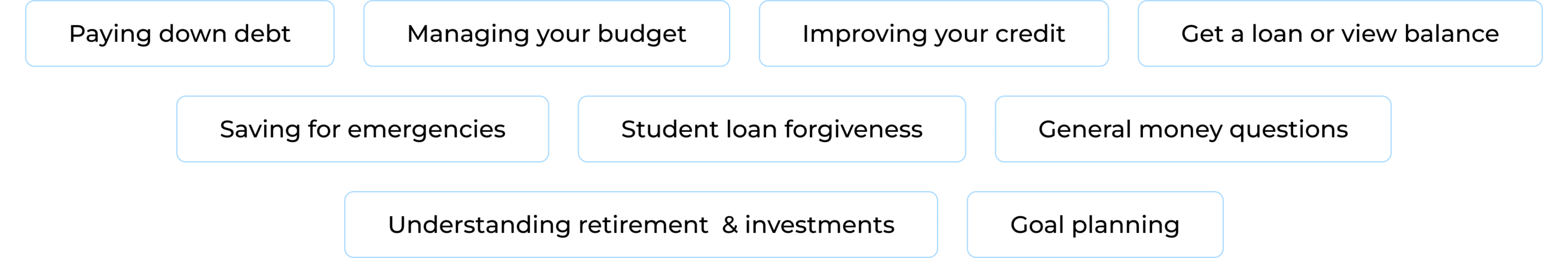

What topics are covered?

Money affects all aspects of our lives. Our financial coaches can help you create a plan of action to meet your own unique goals.

Major life events like getting married, having a baby, buying a home, or retiring should be exciting, not stressful. At FinPath, we’ll help you create a personalized plan to manage your financial situation so you can focus on what matters most to you.

NOW AVAILABLE: On-Demand Financial Coaching

On-demand coaching is only available for registered users.

Ready to meet with a coach?

Our Financial Coaches have the experience and knowledge to guide you through a process of financial self-discovery and assist you in reaching long-term financial goals by providing the framework and resources you need to be successful.

Meet your coaches.

Financial Coach

Aaron Hennig

Financial Coach

Katie Wright

Financial Coach

Janett Tapia

Financial Coach

Daryl Smith

Financial Coach

Jose Pequeno

Why do people

love FinPath?

You may still be wondering…

What does a Financial Coach do?

A Financial Coach helps you understand the basics of money management. This includes budgeting, managing debt, dealing with debt collection, and setting retirement goals. We’re here to make these concepts easy to understand and put you in control of your finances.

Are Financial Coaches certified?

Yes! Our Certified Personal Finance Coaches, have the experience to help walk you through the multiple aspects of creating a strong financial foundation, along with the habits and knowledge to create a sound financial future.

How can a Financial Coach help reduce my money-related stress?

With a blend of expertise, empathy, and personalized support, we strive to make financial wellbeing accessible and achievable for everyone. Through unlimited one-on-one financial coaching, comprehensive FinPath courses, and a suite of powerful financial health tools, we empower you to achieve self-sustainability and lasting financial success.

What will a Financial Coach not do?

- We won’t discipline you to attend sessions, or penalize you for canceling. We know how busy life can be! But much like your physical and mental health, you will see better results with your financial wellness if you are more consistent with sessions and dedicating time to practicing good financial habits.

Can a Financial Coach build wealth for me?

A coach cannot manage your assets. For example, a coach will not manage your investment portfolio or estate planning. However, our coaches will provide guidance, resources, and tools for you to make your own well-educated decisions and be confident in your money skills.

WANT TO LEARN MORE?

Download Our App!

Get tailored guidance with FinPath.